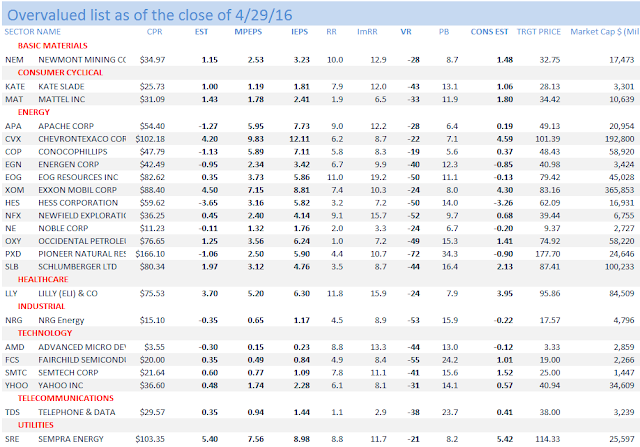

Thirty equities

with significant buyback programs in the last 7 years show that their average EPS

grew at 9.9% pa while Net Profit gained only 4.9% (Median numbers are 8.1 vs

1.7%.) Using the averages, the give up is 5.0% pa which is an enormous

difference in the amount of cash generated.

Our analysis

is based on the Net Profit Test which asks the question: what rate of return is required on investing the

buyback funds to grow the Net Profit and EPS at the same rate as the Earnings per Share (EPS) grew due to the buyback. The

answer is not very much. The average for

the 30 stocks is 5.8% and the median 5.4%.

This give up

in Net Profit is directly attributable to the size of the buyback program as

shown in this chart. On the x-axis we

have the size of the reduction in shares outstanding from 2008 to 2015. On the y-axis, we show the give up in the

growth of EPS and Net Profit. The

correlation between the two is 0.94. In

plain English, the larger the buyback program, the greater the penalty as

measured by cash generation.

There are two main reasons for this apparent anomaly. One, the price paid for the shares is too much to compete with alternative investments (the average P/E for all stocks is 15x for the period). An example of this is given in the paper “The Net Profit Test: Comparing Buybacks to Investment”. Secondly, the correlation between each equities annual percentage of total buyback and average annual price is very a positive: it averages 0 .48 and the median is 0.59. The exceptions are ANTM (-0.60), CSCO (-0.03), GPS (-0.33), TMK (-0.12) AND TRV (-0.16).

Ranked from the bottom in terms of Required Return to equal EPS growth we have BOBE (-0.7%), MCD (2.3%), LM (2.9%), KO (3.7%), DRI (3.8%), KMB (2.9%), VAR (4.3%), FOSL (4.3%), CAKE (4.5%), OMC (4.8%), AAPL (5.0%), ALL (5.1%), TXN (5.1%), PH (5.2%), SHW (5.3%) and DE at 5.4%.

Correl

is the Correlation between average stock

price and the %age of annual buyback to total buyback from 2009 to 2015. There is a definite positive correlation

between the size of the annual buyback and the price.

|

Shares

O/S

is the %age contraction from 2008 to 2015

|

Cost

(B$)

is the cost in Billions of total shares bought back from 2009 to 2015

|

%

Growth

in EPS and NET PRF is the % annual growth in Earnings per Share and Net

Profit from 2008 to 2015

|

Give

up

is the difference between the growth in EPS and growth in Net Profit.

Required

Return ADJ and NOM. The nominal required return is the % growth

applied to the buyback cost to equalize the growth in net profit to earnings

per share growth. ADJ is the adjusted

required return to reflect that our method of calculation of buyback cost is less than actual cost (using last 4 years

of data)

|

Average

Prc/Bk (Price/Book Value) and Ave P/E (Average Price to Earnings

ratio) are based on 2009-2015

|

|

May 4. 2016 corequity.blogspot.com